Recap of Fintech Meetup 2023

Las Vegas hosted a new, in-person conference this week: Fintech Meetup. The event has been around for years in a remote, virtual format due to the pandemic.

Attendees, exhibitors, speakers, and sponsors experienced a well-executed gathering full of quality content and connections. From Sunday to Wednesday (3/19 - 3/22), the Aria in Las Vegas was buzzing with fintech and banking energy.

The conference spanned 3 levels of Aria’s convention center and featured discussion panels split into various tracks (Consumer Banking & Personal Finance, Lending & Credit, Legal & Regulatory: Business Issues, B2B Payments & Finance, Banking-as-a-Service & Embedded Finance). Attendees were able to sit in a variety of topics or focus only on one throughout the event.

1:1 Meetings

The majority of industry folk in attendance agreed that the 1:1 meetings were the most uniquely executed out of all the top fintech conferences. The week prior to the event, attendees were given deadlines in making meeting requests and accepting finalized requests. Fintech Meetup reviewed all requests and then scheduled all opt-in meetings two days before the event started. Between 2 large conference rooms, there were nearly 1,000 small tables set up and numbered for folks to have a 10-15 minute discussion.

This approach helped ensure that these brief meetings were attended and discussions were engaging. Of the 6 scheduled 1:1s, only one had a no-show (who I connected with separately the day after).

The downside was that there were other quality contacts that would be missed if a meeting wasn’t scheduled. The list attendees was removed from the Fintech Meetup application once all 1:1s were set, and there was no way to directly message or find key contacts during the event.

TABLETALKS

This was the other part of the conference that stood out. Groups of 8 attendees were assigned a table and topic to cover during lunch.

Once again, Fintech Meetup curated the mix of individuals to ensure a clear overlap in business focus across the table. I was part of Table 108, which was assigned questions on Embedded Finance — the discussion shifted between Banking-as-a-Service and InsurTech.

Overall, embedded finance and BaaS are still unclear concepts even to industry insiders focused on software development (front-end, design) or building products directly for banks.

PANELS

The speaker sessions started early on the first day of there conference (Sunday). For the most part, this is when attendees are flying in and settling into their hotel room. Fintech Meetup had 3-4 panels starting at 2p and networking event in the evening, which was well attended.

Here are the sessions we got a chance to attend and a few notes about what was discussed:

How Fintech is Transforming Payments and Receivables

Panelists: TD Bank, Banc of California , Melio Payments

The innovation from managing accounts payable and accounts receivable in the last decade mostly centers on user experience — going from paper to digital (no need to print invoices and mail), combining both payables and receivables, reconciliation in automating payments to invoices;

The three, high-level problems being addressed: workflow, cashflow, learning new technology;

From the bank perspective: there’s deep engagement with merchant services, card, improving acquisition experience, and fintech partnerships that align with their culture (i.e. benefiting from engagements, relationships, investments); being able to move the needle on the user experience beyond a bank’s capabilities;

Why are virtual cards all the buzz? half of fintech companies are standing on Durbin amendment provisions for higher interchange revenue; card transactions are easier to track and generate insights automatically for business clients; specific account numbers can connect to specific users and add controls for security; convert paper checks to card rails;

Key takeaway: 25% of businesses are managed by individuals who only have a highschool level of education — support, tools, and more resources are needed facilitate administrative functions (such as reconciling invoices);

1:1 w\ Marqueta’s former CEO, Jason Gardner

Feedback and expectations from the fallout of Silicon Valley Bank? Clients expect deposits in their bank to be safe and available to pay bills and run their business; multiple ups & downs in the span of a week — the lifeline from SVB then the stress of not being able to pay bills;

Long-term implications with SVB? They were the bank for startups globally (not just in the US) and the tech ecosystem depended heavily on them — introductions to VCs, how to navigate the Valley, etc. will now be a miss for entrepreneurs building new businesses. Mid-market banks will have pressure from all entrepreneurs (not just those from tech) to be an option for their business.

Recently stepping down as CEO (6 weeks ago): doesn’t see himself as the right person to run a public company, which is an incredibly intense endeavor and wanted to prioritize a broader lens of what’s next for Marqeta and the industry. It’s a personal priority to spend time with family and work on non-fintech interests (such as music, art). No focus in starting a new company yet or becoming a VC.

Context on the acquisition of Power: Marqeta is a big believer in embedded finance and pioneered modern card issuing, which is the foundation of embedded finance. Program management is a precise part of credit card processing and there are non-processing parts of running a card product for a company (e.g. Reg Z compliance, statements, how payments get applied, etc.). Power has this in place already for credit cards — Marqeta decided not to build it out over the next 18 months in-house since Power’s tech stack is already optimal;

Marqeta’s stock price still down this year: Investors have general concerns with the market as a whole, not just fintech; the renewal of Block in 2024 not being officially announced is a concern (due to the concentration risk in revenue). Incentives from card networks were lost for 2 customers, which impacted gross profit in 2023. Hopeful in this turning around based on strong pipeline, especially with credit card processing;

How Banking-as-a-Service enables any company to be a FinTech

Panelists: Bond, Novo Payment, Fifth Third Bank;

What makes you different?

Bond – full stack banking platform focused on credit products for startups and large organizations; bank agnostic with several banks under the hood (chosen based on product); leverages multiple vendors (KYC, KYB) and monetizes through platform fee (for accessing technology and white label solution), usage (number of users, transactions), and interchange share;

NovoPayment – fintech infrastructure provider; delivers APIs across multiple sectors with a focus on companies in the US and across 14 areas in LATAM; charges for setup of program and its components, monthly subscription fee in place once platform is live (spread out over 3-5 years based on growth); no revenue share;

Fifth Third Bank – has BaaS division; built vertically integrated business that is enterprise grade in nature and tech agnostic (i.e. bring your stack or use theirs); works with ADP, FIS, Fiserv, Brex, Toast; focuses on non-interest income (interchange), interest income (deposit rates); able to structure commercials in a way that fits needs of enterprises;

What it looks like to build and change product (based on compliance, legal, prod, program, ops stakeholders):

program defined by funds flow, then everything is built and signed off from there (towards a compliant product);

put a recipe together for the ingredients (APIs, etc.);

program manager to make sure the fintech is doing what they’re supposed to be doing;

white-label makes it easier for brands for launch program for existing clients;

Other takeaways:

NovoPayments started in fintech because at the bank that the CEO (Anabel P.) worked, innovation was slow — no direct way to help onboard clients quickly and impact the customer experience;

Fifth Third Bank relayed that its hard to ‘servicefy’ banking since risk & controls are an ever-evolving, moving target. It’s difficult to simplify and abstract it to an extent — if you want to do something different or better, there’s only so far you can go with something that is already productified. Standard use cases can get up & running quickly, but anything bespoke requires managing risk & reinvention (if possible);

Putting Brands First with Embedded Finance

Panelists: Tandym (Jennifer, CEO); Yuval, Rob (CEO at Bolttech – insurance)

Why is embeded finance a gamechanger for the industry?

$100M+ in growth over the next decade for growth in the insurance market;

driving growth, consumer expectations + experience; users want piece of mind and their lives to made easier through an embedded experience;

the ability to offer financial services experience without being a bank is new;

younger consumers don’t identify with traditional financial institutions;

its the future of consumerism in financial services;

new ways of getting to banking needs without going to a bank, but using a brand they love

Every company will be a fintech?

what are businesses trying to do, who are they trying to serve – fintech makes the process easier for businesses to serve clients through embedded finance as a new part of their total offering;

opportunity in B2B (not just in B2C) to streamline money movement, but there should be a need for banking (not just payments);

For insurance, the analogy is that you ‘need a great car & great driver’ — this deep insurance expertise and understanding where the market is going, plus being able to use technology to put it altogether;

Other takeaways:

embedded finance is helping businesses have stickier customer (deeper relationships);

allows companies to not have to compete on other elements (such as price), by giving customers another reason to come back;

for banks & BaaS platforms — go to where the customers already are; there’s already a relationship there and the ability to strengthen it;

Customers want to stay within a platform they already trust – where they have an existing affinity;

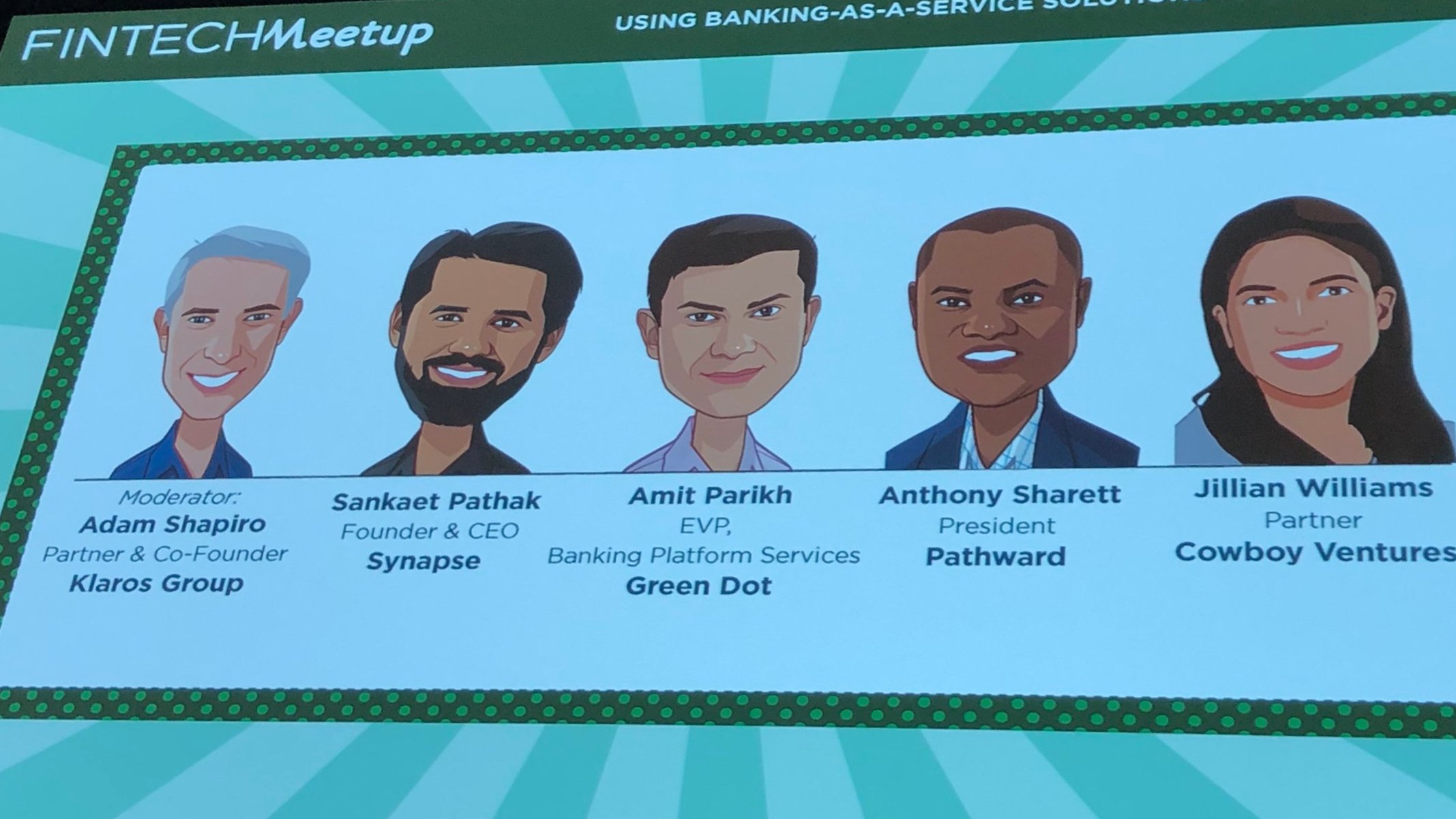

How Banking-as-a-Service Solutions Accelerate Innovation

Panelists: Pathward, GreenDot, Synapse, Cowboy Ventures;

What’s the right mix to accelerate innovation in this space?

Pathward – alignment on use case and mission; will bank be allowed to perform 3rd party oversight needed and expected by regulators; finding a gap in the market together; everyone trying to get into the BaaS;

GreenDot - started with the operational side and used 3rd parties for bank and ops; after buying a bank in 2010, now has it all in-house which helps with customer experience scaling; for BaaS platforms its all about how you create the right processes to continue to scale;

Synapse – solve the ‘cold start’ problem so this can be profitable for partner banks and all parties; instead of expecting banks to do everything, a bank can be given a single feature to focus on that they do very well; able to work with a spectrum of banks (those starting out or ones that have systems in place); can’t be an experiment or an expectation to make a profit quickly; bank partners making the right investment in their own oversight;

Cowboy Partners (invest in early stage companies) – banks an fintechs both looking for customer experience and scale;

Other takeaways:

3rd party risk – bar rising in the regulatory world; OCC & Fed to increase quality of supervision on partner banks;

Don’t hear about fintechs trying to get bank charters anymore – difficult to scale so its died down;

Smaller financial institutions and credit unions are having a difficult time in suspicious activity reporting (SARs),anti-money laundering (AML), and managing money movement; can’t rely on artificial intelligence (AI) – need people that are experienced and trained;

Over 80% of customer complaints fall into 3 categories – money movement claims, disputes, locked accounts;

3 aspects that regulators look out for: (i) money movement, (ii) consumer protections, (iii) UDAAP — bank is responsible for all 3 areas;

Going direct to a bank may make no sense if you need a bespoke model for screening users;

For many fintechs, a BaaS platform can be helpful to avoid managing multiple vendors;

BaaS is a software tool for efficiencies in processes but doesn’t circumnavigate the responsibility of these areas;

Embedded finance in which companies can drag & drop functionality into their applications (similar to what Plaif does for bank logins) is still far away;

OUTLOOK FOR NEXT YEAR’S FINTECH MEETUP CONFERENCE

The majority of attendees were pleased with the quality of the conference (from venue, connections, events, panels) and looked forward to 2024’s event, which is expected to be at The Venetian.

The team from Fintech Meetup raised the bar for industry conferences in terms of facilitating deeper connections and discussions. In order to do pull this off, there needs to be right mix of attendees and volume — banks, VCs, vendors, and platforms seemed evenly balanced.

Excited for what’s come from the new industry connections made and next year’s event!

Join our community @FinTechtris for more industry content & insights (including deep dives & sector spotlights).

As a bonus, access our subscriber-only resources for evaluating and building the next generation of financial services. Signup today —>